Can I Switch From My Secured Credit Card to an Unsecured One?

Some secured cards offer a path to automatically upgrade. With other cards, you can call and ask for the change.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

If you have a secured credit card — which requires a cash deposit that becomes your credit limit — it's often possible to eventually "graduate" to an unsecured card and get that deposit back. But that process can vary depending on the issuer:

- Many major credit card issuers provide an automatic upgrade path, where they review your card use after a few months and determine whether you qualify for a switch.

- With other card issuers, you won't get the benefit of automatic or periodic reviews, but you can call on your own and ask to upgrade your credit card.

- And with some smaller issuers, there are no card options at all when you're ready to move up. In that case, you'll need to close the account to get your deposit back and then consider other issuers.

Here are cards with specific upgrade paths, as well as what to know when you're ready to switch from a secured credit card to an unsecured one.

Trying to get approved for a card?

Create a NerdWallet account for insight on your credit score and personalized recommendations for the right card for you.

In this article

Secured credit cards that spell out their upgrade paths

Certain cards specifically mention an upgrade path in their marketing materials. Of course, this is not a promise of an upgrade. You’ll need to qualify based on your account activity.

But in the case of these cards, you’d simply use your card responsibly until you’re notified of the ability to switch:

The Discover it® Secured Credit Card starts reviewing your account monthly once you’ve had the card for seven months. If Discover determines that you’re eligible, you'll be able to graduate to a traditional unsecured Discover product and get your deposit back. You'll retain the same account number, which is good for your length of credit history, a major factor in your credit scores. In the meantime, you'll be holding the rare secured credit card that earns rewards. There's a minimum deposit of $200, but the annual fee is $0.

With the Capital One Platinum Secured Credit Card, you can automatically be considered for a higher credit limit in as little as six months, without having to make an additional deposit. Capital One will also monitor your card activity to see whether you’re eligible for a deposit refund. The card's annual fee is $0, and unlike other secured cards, applicants may be able to qualify for a credit limit larger than their deposit. Terms apply.

The BankAmericard® Secured Credit Card is a bit less specific, stating that your account will be “periodically” reviewed. If you qualify, Bank of America® will refund your security deposit based on your overall credit history and other factors like other credit cards and loans.

All three of these options are issued by banks that offer a variety of unsecured cards, so once you build your credit, you can consider upgrading to a card from the same bank. You can always call and inquire about your options if the issuer hasn’t notified you already.

What to do if your secured card is unclear about upgrades

Some secured cards provide murky upgrade details, or simply don’t offer other cards to graduate to. Holders of the opensky® Secured Visa® Credit Card can be eligible to apply for a related unsecured card in as little as six months, according to the card's issuer, Capital Bank. But it's not clear what it takes to become eligible — or whether this is a true upgrade from a secured account or just the opportunity to open a new unsecured account.

Similarly, all three of the First Progress cards are secured.

In these cases, you can still get your deposit back, but only once you close the account. If you then want to move on to a new unsecured card, you'll need to look elsewhere — though your options will depend on how much your credit has improved.

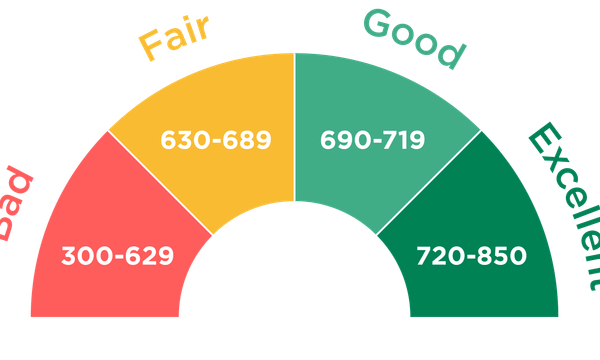

- Credit cards for fair credit could be a fit if you’ve attained a FICO score of at least 630.

- You can also consider so-called alternative credit cards, which are offered by financial startups and can use nontraditional underwriting to evaluate applications.

How to improve your odds of graduating to an unsecured card

The point of a secured card is to build or rebuild your credit. To improve your eligibility odds for unsecured cards with perks and rewards programs, you’ll need to use your secured card carefully. Here’s how to do that:

- Make sure your card activity counts: Opt for a card that reports your account activity to the three major credit bureaus.

- Pay your bills on time (and ideally in full), every time: Your payment history accounts for 35% of your FICO scores, and late payments can result in steep fees. Many secured cards charge high interest rates, so paying your bill in full can help you avoid expensive credit card debt.

- Try not to max out your card’s credit limit: Credit utilization, or the portion of your total credit limit you charge each month, accounts for 30% of your FICO score. We recommend you only use 30% of your total credit limit during a billing cycle.

🤓 Nerdy Tip

One way to avoid overcharging is to put some small recurring charges on your secured card and pay the bill in full each month, while using cash or a debit card to pay for everything else. What’s next?

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Related articles