How to Maximize the Platinum Card from American Express

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

SOME CARD INFO MAY BE OUTDATEDAll information about The Centurion® Card from American Express and the Business Centurion® Card from American Express has been collected independently by NerdWallet. The Centurion® Card from American Express and the Business Centurion® Card from American Express are no longer available through NerdWallet. |

The Platinum Card® from American Express is one of the most iconic rewards cards out there, offering several benefits for travelers, including lounge memberships, a long list of transfer partners, various credits, insurance protections and so much more.

In addition to the perks, Membership Rewards points earned on the card are extremely versatile — they can be transferred to 19 airlines and three hotel partners, offering plenty of interesting award redemptions.

Here’s what you need to know about the most important benefits, key transfer partners and strategies for extracting the most value from the card.

An overview

The card has the following welcome offer: You may be eligible for as high as 175,000 Membership Rewards® Points after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

The introductory offer on The Platinum Card® from American Express (see rates and fees ) fluctuates often, and can be as high as 100,000 Membership Rewards points. Terms apply. Keep this in mind when applying so you can time your application to coincide with a high offer.

Highest-value perks

$200 hotel credit

Holders of The Platinum Card® from American Express will receive $200 in statement credits on prepaid hotel bookings made with AmEx Travel at Fine Hotels + Resorts or The Hotel Collection properties (note: stays at The Hotel Collection must be two nights minimum).

With over 1,700 hotels to choose from, if you value stays at these high-end properties, these credits will come in handy. The value provided is in addition to the other statement credits and perks offered for staying at these hotels. Terms apply.

$300 Equinox gym credit

Equinox gyms are well-known for being luxurious and expensive, offering new machines, group fitness classes, personal training, spa treatments and more. When you use The Platinum Card® from American Express to pay for your membership or for the Equinox+ app, you will receive $300 of annual statement credits ($25 per month). Terms apply.

$240 digital entertainment credit

Cardholders can get up to $20 per month as a statement credit when using The Platinum Card® from American Express to pay for eligible digital purchases from:

The Disney+ Bundle.

ESPN+.

Hulu.

Peacock.

The New York Times.

The Wall Street Journal.

If you use these services already, a monthly $20 statement credit is a great benefit. Enrollment required. Terms apply.

$199 CLEAR+® credit

CLEAR provides members a touchless ID service by scanning their face and eyes, allowing them to bypass parts of airport security lanes and go through stadium verification checks faster. An annual CLEAR+® membership costs $199, and The Platinum Card® from American Express will offer an annual credit to offset the cost of the membership when it is charged on the card. Terms apply.

Centurion Network expansion

The Centurion Network has been expanded, with over 40 Centurion Lounge and Studio locations globally. Increased access is a welcome development, especially since the Priority Pass lounge membership through American Express doesn’t include restaurants. Enrollment required for Priority Pass. Terms apply.

Wheels Up: A premium private jet program

Wheels Up provides access to private jet rentals. There are several membership levels, and reservations can be made through the Wheels Up app. Holders of The Platinum Card® from American Express and the Centurion Card are eligible for discounts, flight credits and capped hourly rates on reservations and memberships to the program. Terms apply.

» Learn more: Flying semi-private on JSX — a review

Global dining access by Resy

Cardmembers can take advantage of elevated dining experiences, including access to tables at exclusive restaurants, curated experiences and presales to dining events. Terms apply.

How to make the most of The Platinum Card® from American Express

Know the key Membership Rewards transfer partners

As a holder of The Platinum Card® from American Express, you earn Membership Rewards points anytime you use your card. These points are valuable because they can be transferred to the following 22 airline and hotel partners:

With this many options, it can get confusing to figure out which partner it makes sense to transfer to. As a general rule, you will fare better with airlines than hotels because airline points can result in stronger redemptions, especially if you’re flying in premium cabins.

Some airline partners are better than others, and you’ll want to familiarize yourself with which ones you should generally avoid. You can also extract decent value if you redeem your points to book travel through the AmEx Travel portal.

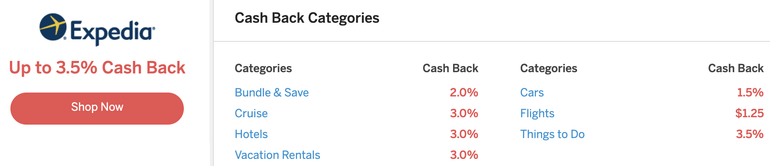

Take advantage of all the other statement credits

The Platinum Card® from American Express offers several cash-back credits in a variety of categories. Examine each so you can figure out the best way to maximize them.

$200 airline fee credit

This $200 airline fee credit is provided each calendar year and can be used on purchases with the following airlines: Alaska, American, Delta, Frontier, Hawaiian, JetBlue, Spirit, Southwest or United. Terms apply.*

Unlike the $300 travel statement credit on the Chase Sapphire Reserve®, this $200 credit is not as straightforward. First, you’ll need to select an airline online or by calling the number on the back of your card. Second, only “incidental air travel fees” are eligible for reimbursement. AmEx specifically states that plane tickets, upgrades, points purchases, gift cards, award tickets and more are not considered incidental charges.

So what qualifies? While there is no official policy, users report that baggage charges, change fees, pet flight fees, seat choices and in-flight food purchases have triggered the credit. If you have a specific airline charge you’re wondering about, it's best to call AmEx to confirm.

You are allowed to change your airline selection each January, so make sure you know your designated airline and use your card for charges accordingly. This is a use-it-or-lose-it annual credit. Enrollment required. Terms apply.

Since the $200 statement credit is based on a calendar year, you could earn the credit twice ($400 total) in your first 12 months of card membership. If you get the card in July, you have until Dec. 31 of that year to use up the entire $200 airline credit. In January, the credit will reset and you have another $200 to apply to incidental purchases.

$200 Uber credit, including for food delivery

AmEx provides a monthly $15 credit in the form of Uber Cash (plus an additional $20 credit in December) for a yearly credit of $200. Uber Cash can be used on rides or on food orders through Uber Eats, which is great considering that many people are not traveling very much or commuting to work right now. The monthly credit expires at the end of each month and does not roll over, so put a reminder in your calendar to order delivery once per month if you’re not using ridesharing right now.

To use the benefit, you’ll need to turn on Uber Cash within the app when you’re requesting a ride or ordering food. Starting Nov. 8, 2024, you'll also need to pay for your ride or food delivery with The Platinum Card® from American Express to use the credit. Only rides in the U.S. qualify, so this credit is unfortunately of little use if you only use Uber abroad. Enrollment required. Terms apply.

$100 Saks Fifth Avenue credit

The Platinum Card® from American Express offers a $50 statement credit toward Saks purchases from January through June, and a second $50 credit from July through December, for a total of $100.

Saks often has promotional offers and has a dedicated sale section on their website, so even if you’re not a frequent shopper at the store, you should be able to find something to use up the $100 credit. In addition, you can double dip here and use another perk offered by The Platinum Card® from American Express: Free shipping through ShopRunner (more below) gets your package to you in just two days. Enrollment required. Terms apply.

When shopping at Saks, make sure to click through a shopping portal of your choice (use Cashback Monitor to compare point/cash-back offers) so that you also earn bonus points/cash back on your purchase.

Use the Global Entry or TSA PreCheck fee credit

The Platinum Card® from American Express is one of the many cards that offer a Global Entry or TSA PreCheck credit. Both of these programs allow you to expedite your time spent at the airport.

When you have TSA PreCheck, you don’t need to take off your shoes, belt or light jacket when going through security, and you won't have to remove your laptop or liquids from your carry-on. The membership costs $78 and lasts for five years.

Global Entry offers all the benefits of TSA PreCheck but also provides expedited entry into the United States when you’re returning from abroad (because you don’t need to wait in line or fill out any paperwork). You can easily pass through border control by entering your credentials into a Global Entry kiosk. The cost of Global Entry is $120 and membership lasts for five years.

When you use The Platinum Card® from American Express to pay for Global Entry or TSA PreCheck, you will get a statement credit equal to the cost of the membership. The credit can actually be used every four years for TSA PreCheck and every 4.5 years for Global Entry, because you will need to reapply for membership during your fourth year before it expires. Terms apply.

Apply for Global Entry because TSA PreCheck is included with Global Entry membership. The Platinum Card® from American Express will reimburse you for whichever program you choose, so you might as well choose the most comprehensive.

» Learn more: TSA PreCheck vs. Global Entry: Which is right for you?

Book travel to get 5x Membership Rewards points on airfare and hotels

When you use The Platinum Card® from American Express to make airfare purchases directly with airlines or through AmEx Travel, you will earn 5 Membership Rewards points for every $1 spent, on up to $500,000 a year in spending. You also earn 5x on prepaid hotels booked through AmEx Travel. Terms apply.

» Learn more: The guide to the AmEx travel portal

Advanced tactic: Pair with another card, and use a shopping portal too

Although 5x is a solid earn rate for these categories, you can get even more points by being a little creative. You could use another premium travel card to book the hotel, while also earning points from the shopping portal purchase. Use a tool like Cashback Monitor to compare the point earn rates on different shopping portals.

Furthermore, American Express sometimes has offers directly with hotels or online travel agencies that allow you to earn cash-back credits. Terms apply.

Another thing to keep in mind is that hotels sometimes offer discounted rates to customers booking directly, so you may also see a different rate when you’re logged into your hotel account than on AmEx Travel. If you see a cheaper rate, check Cashback Monitor or Rakuten (if you just want to earn AmEx points) so you can also earn points for booking with the hotel directly.

» Learn more: High-value AmEx offers to bookmark

Book with the Fine Hotels + Resorts program

Holders of The Platinum Card® from American Express and The Business Platinum Card® from American Express have access to the Fine Hotels + Resorts program, or FHR, which is AmEx’s collection of luxury hotels. By using your card to book a hotel through this program, you get a slew of nice perks such as:

Daily breakfast for two.

Room upgrade, if available.

Property amenity valued at $100.

Guaranteed 4 p.m. late checkout.

Noon check-in, if available.

Complimentary Wi-Fi.

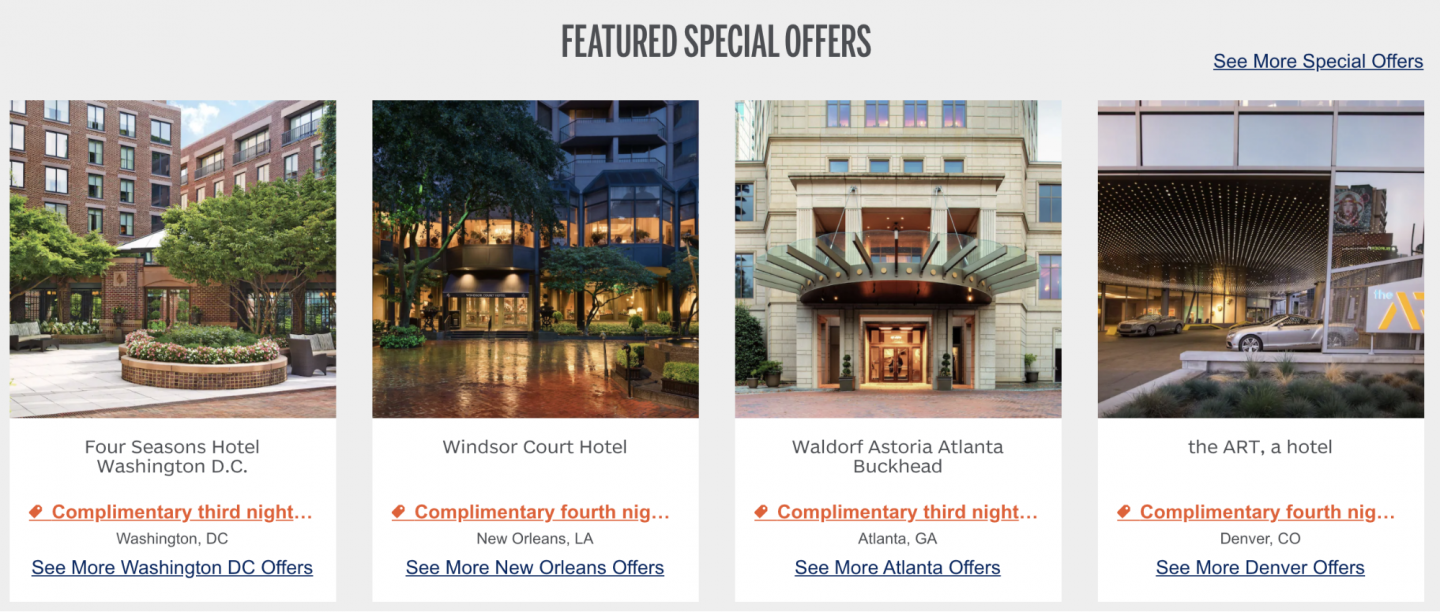

In addition, some of the properties offer a complimentary third or fourth night, which can really make a difference given how expensive the hotels are. Some of the currently available offers include the below:

Although AmEx values the FHR benefit at $550, you could extract even more from it. If the hotel is part of a chain that you have loyalty status with or you already hold a free night certificate, you can combine these perks.

For example, as seen above, the Waldorf Astoria Atlanta Buckhead is offering a complimentary third night when booked through FHR. The Waldorf Astoria brand belongs to Hilton. If you have a Hilton free night certificate, you could use the certificate to extend your stay. Terms apply.

Visit the Global Lounge Collection

The Craft Beer Bar inside The Centurion Lounge at Denver International Airport. Photo courtesy of American Express.

The Platinum Card® from American Express and The Business Platinum Card® from American Express provide access to this excellent lounge program, which includes 1,400 airport lounges across 140 countries.

The collection of lounges includes AmEx’s Centurion lounges, International American Express lounges, Delta Sky Club lounges (10 visits per year when flying on Delta) and some Priority Pass locations.

Access to Centurion Lounges is free for the cardmember, but they'll have to pay a $50 guest fee (or $30 for children ages 2 to 17) to get access for any travel companions. The exception is for cardmembers who have spent $75,000 on their card in the prior calendar year; these members will maintain complimentary guest access. Terms apply.

Access to Delta Sky Club lounge is also limited. The cardholder must show a Delta boarding pass and they only receive 10 visits per year, unless they've spent $75,000 on their card in the previous calendar year. If that threshold is met, cardholders will get unlimited access to Delta Sky Clubs when flying Delta.

Out of all the options offered, the Centurion Lounges are the best due to their selection of premium food and drink. These lounges are also not as crowded as Priority Pass lounges because not as many people have access to them. However, there are currently only 26 Centurion Lounge locations globally.

To maximize this benefit, be sure to research participating lounge locations near you, places you travel frequently or potential layovers or destinations for future trips. A typical visit to these types of lounges runs about $29-$32 per person, so the value of this benefit can add up quickly with a little advance planning. Terms apply.

One seating area in the Las Vegas Convention Center American Express Lounge. (Photo by Sally French)

Beyond airport lounges are a couple of convention center lounges, too. There are currently two American Express Business Lounges accessible to cardholders: one at the Las Vegas Convention Center, and the other at Jacob K. Javits Convention Center in New York City. Inside you’ll find complimentary snacks, free Wi-Fi and myriad outlets to recharge your electronics — all in a place to recharge yourself with plentiful plush couches.

Leverage the Hilton and Marriott Gold elite status

The Platinum Card® from American Express is a premium travel card, so it makes perfect sense that it provides complimentary elite status with leading hotel chains Hilton and Marriott. The status remains valid for as long as you hold the card. Both of these statuses offer great perks such as late checkout, bonus points earned and much more. Enrollment required. Terms apply.

If you don’t already have a higher status at one of these hotels chains, it makes sense to focus your travel so you’re staying at these brands frequently. In this way, you'll be able to reap the benefits of your Gold status and maximize the value of your credit card.

Rent cars with Avis, Hertz and National

The Platinum Card® from American Express also provides the following elite status with three car rental companies:

When you get the card, you’ll need to set up an account with each car rental company to get status. Benefits of elite status with the car rental companies include separate lines at the counter, e-returns and the ability to use your car rental points for rewards. Once you’re set up, make these three your go-to car rental companies so you can benefit from the elite status. Enrollment required. Terms apply.

The best of the rest

Use these secondary benefits of the card to extract even more net value over the annual fee.

Platinum Card concierge

This service is available 24/7 and can assist you with booking dinner reservations worldwide, finding a gift and more. The best part about this feature is that you could use the concierge service to make reservations directly through your AmEx mobile app.

If you’d prefer to have AmEx assist you, the concierge service offers assistance over the phone as well. While there is no monetary value to this service, you can utilize the concierge and the app to save you time. Terms apply.

Complimentary ShopRunner membership

ShopRunner is a subscription-based service that offers free two-day shipping and free returns from a wide selection of merchants. The annual subscription costs $79, but AmEx is one of a variety of credit card issuers offering it for free. To use your benefit, go to ShopRunner's AmEx page and enroll. You will need to have your credit card handy. Enrollment required. Terms apply.

No foreign transaction fees

If you travel internationally, you could be stuck paying foreign transaction fees of up to 3% on purchases you make abroad. As a premium travel card, The Platinum Card® from American Express doesn't charge foreign transaction fees. Take it with you when making purchases abroad so you’re only paying the U.S. dollar equivalent of the local currency, but keep in mind that American Express cards are generally accepted in fewer locations internationally when compared to Visa or Mastercard. Terms apply.

Travel insurance protections

Many premium travel cards offer insurance protections, and again, The Platinum Card® from American Express does a great job in this category, offering four types of benefits. To qualify, you must charge the entire amount of your trip on The Platinum Card® from American Express.

Trip cancellation and interruption: AmEx will reimburse you for any nonrefundable deposits up to $10,000 per trip.

Trip delay: Reimbursement for eligible expenses up to $500 if your trip is delayed by six hours or more.

Car rental loss and damage: Insurance protection for up to $75,000 if the car is lost or stolen.

Terms apply.

Many of these protections may be sufficient for your travel insurance needs, which can limit or replace the need for third-party travel insurance. Just remember to book your trips on The Platinum Card® from American Express. To see these benefits discussed in detail, refer to our guide to AmEx trip cancellation and travel insurance.

Shopping protections

When you use your card to make purchases, you will receive three different types of shopping protection. With these benefits, you’ll want to ensure you’re charging purchases to this card for items that may qualify.

Purchase protection: Items that are lost, damaged or stolen may receive purchase protection for up to 90 days from the time they were purchased. Coverage is up to $10,000 per event and $50,000 per calendar year.

Return protection: If a merchant won't accept a return of an item purchased within 90 days, AmEx will refund the purchase price (less shipping and handling) up to $300 per item, up to a total of $1,000 per calendar year.

Extended warranty: This benefit provides an extra year of warranty protection beyond the manufacturer's original warranty.

Terms apply.

If you want to maximize The Platinum Card® from American Express

Although The Platinum Card® from American Express will increase the annual fee by $145 from $550 to $695, you can still extract value and offset the annual fee if you take advantage of the numerous statement credits (e.g., airline, hotel, digital entertainment, Equinox, CLEAR+® membership, Uber, Saks) and use the most valuable benefits (e.g., lounge access and insurance protections).

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Car Rental Loss & Damage Insurance

Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

To view rates and fees of The Platinum Card® from American Express, see this page.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2025:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph® Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

Capital One Venture X Rewards Credit Card

Travel

Hotel

With a big sign-up bonus, travel credits, high rewards and airport lounge access, this card could be well worth its annual fee — which is lower than many competitors.